How stocks are traded ?

Learn Trading

How Stocks are Traded on the Stock- Before Vs. Today

Market Historical Context

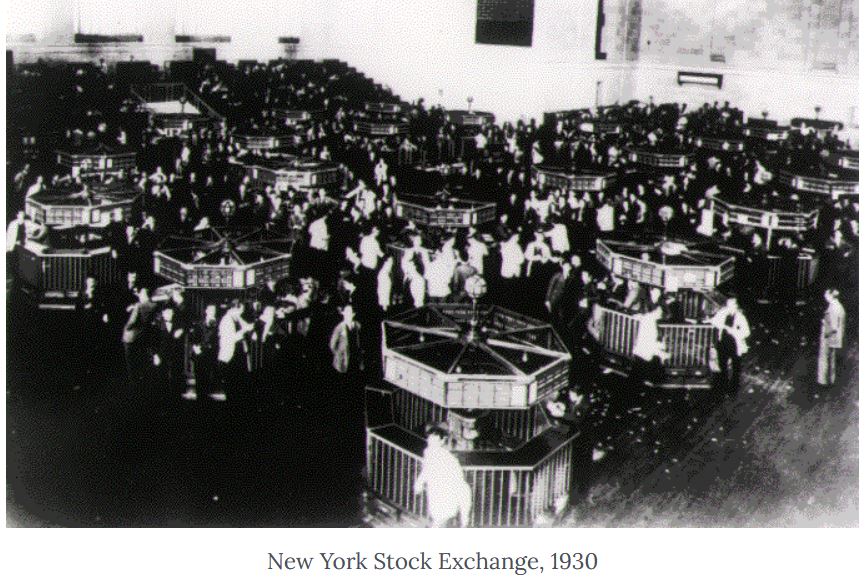

In 1792, the foundation of stock trading was laid with the signing of the Buttonwood Agreement by 24 stockbrokers and merchants. This agreement marked the beginnings of the New York Stock Exchange. At that time, trading was done in person, often under a buttonwood tree on Wall Street. Brokers representing sellers would find brokers with buying interests, negotiate prices verbally, and exchange physical stock certificates.

The Transformation into Modern Stock Trading

As the financial markets evolved, so did the methods of trading. The physical exchange of paper certificates gave way to telegraphic communications in the late 19th and early 20th centuries, which further evolved into electronic trading systems in the late 20th century.

Modern Stock Trading Mechanisms

Today, stock trading is largely governed by advanced electronic trading platforms and computer algorithms. Here’s how the process works in real time:

Electronic Trading Platforms:

Platforms such as the New York Stock Exchange (NYSE), NASDAQ, and various other global exchanges handle the bulk of stock transactions electronically. For example, NASDAQ is a completely electronic exchange where all trading is done over a network of computers, which offers speed and efficiency advantages.

The Role of Brokers and Dealers:

In contemporary trading, brokers and dealers use sophisticated software to buy and sell stocks. Retail traders might use platforms like E*TRADE or Robinhood, which provide user-friendly interfaces for trading stocks. Institutional investors might use more complex systems like Bloomberg Terminal or Reuters Xtra for real-time trading and financial analysis.

Market Makers and Liquidity:

Market makers are firms or individuals who actively quote two-sided markets in a given stock, providing bids (buy prices) and asks (sell prices) along with maintaining an inventory of stocks. This process ensures liquidity, making it easier to buy or sell stocks at any given time without waiting for a direct counterparty. For instance, if you wish to sell shares of Apple Inc., you do not need to find a buyer yourself; the market maker will purchase your shares if no immediate buyer is found.

Order Execution and the Role of Exchanges:

When an order to buy or sell stocks is placed, it can be executed in various ways. Orders may be placed as market orders, which are executed at the current market price, or limit orders, which set a specific price limit. The exchanges use automated systems to match buy and sell orders efficiently. For example, the NYSE has a system where orders are matched through a combination of electronic and human interaction at the trading floor.

Real-Time Data and High-Frequency Trading (HFT):

Modern stock trading is heavily dependent on real-time data. High-frequency trading algorithms can execute orders in milliseconds, taking advantage of price discrepancies in the market. These systems analyze market conditions extensively and make automated trading decisions based on pre-set criteria.

Example of a Trade Today

Let’s consider a simplified real-time trading example:

A retail investor decides to buy 100 shares of Tesla Inc. using an online brokerage app. The investor places a limit order at $700 per share. Simultaneously, an algorithm from a different trader identifies a selling opportunity for Tesla at $700 per share. The exchange's electronic system matches these orders, and the transaction is completed almost instantaneously, all without the traders ever meeting.

Conclusion

The stock market today operates at a speed and efficiency that are worlds apart from the trading under the buttonwood tree. With the integration of global electronic networks, artificial intelligence, and complex algorithms, the basic principle of stock trading—buying and selling for profit—remains unchanged, but the methods and speed of execution have revolutionized the landscape. This dynamic market continues to grow and change, shaped by technological advancements and regulatory changes worldwide.